In today's fast-paced and highly competitive business environment, accurate financial evaluation is crucial for making informed decisions and managing risk effectively. Whether you are a business owner, investor, or financial professional, having the right tools and methods to evaluate financial data can provide valuable insights and help drive strategic decision-making. This comprehensive guide explores the key tools and methods for ensuring precise financial assessments.

Key Takeaways

- Accurate financial evaluation is essential for effective financial management and informed decision-making.

- Inaccurate financial evaluation can lead to costly mistakes, poor investment decisions, and ineffective risk management.

- Different valuation methods have their strengths and weaknesses; consider multiple methods for a comprehensive understanding.

- Key financial statements such as the balance sheet, income statement, and cash flow statement are crucial for accurate valuation.

- Leveraging technology and adopting best practices can significantly enhance the accuracy of financial valuations.

Understanding Valuation Accuracy Methods

The Importance of Accurate Valuation

Accurate valuation is crucial for making informed financial decisions. Whether you're negotiating purchase terms or planning investments, understanding the true worth of a business can significantly impact your strategy. Accurate valuations help in minimizing risks and maximizing returns.

Common Pitfalls in Valuation

Valuation isn't always straightforward, and there are common pitfalls to be aware of. Overlooking market conditions or relying too heavily on a single method can lead to inaccurate assessments. It's essential to consider multiple valuation methods to get a comprehensive view of a company's worth.

Regularly reviewing and updating your valuation methods can help in avoiding these pitfalls and ensuring more precise financial assessments.

Key Financial Statements for Valuation

Balance Sheet Insights

The balance sheet offers a snapshot of a company's financial position at a specific point in time. It details assets, liabilities, and shareholders' equity, providing a clear picture of what the company owns and owes. Understanding the balance sheet is crucial for assessing a company's net worth and financial stability.

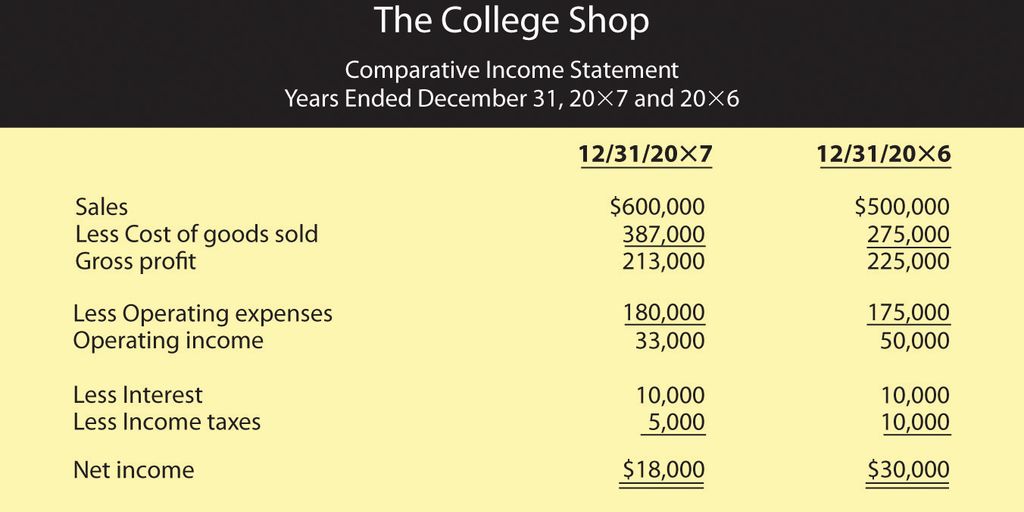

Income Statement Analysis

The income statement, also known as the profit and loss statement, shows the company's revenues and expenses over a period. This statement helps in evaluating the company's profitability and operational efficiency. By analyzing the income statement, investors can determine how well a company generates profit from its operations.

Cash Flow Statement Evaluation

The cash flow statement tracks the flow of cash in and out of the business. It is divided into three sections: operating, investing, and financing activities. This statement is essential for understanding the liquidity and long-term solvency of a company. Monitoring cash flow helps in ensuring that the company can meet its short-term obligations and invest in future growth.

Regularly reviewing these financial statements can provide valuable insights into a company's performance and help in making informed investment decisions.

Ratio Analysis: A Deep Dive

Liquidity Ratios

Liquidity ratios are essential for assessing a company's ability to meet its short-term obligations. These ratios provide insights into the firm's operational efficiency and financial health. Key liquidity ratios include the current ratio and quick ratio. A higher ratio indicates better liquidity, which is crucial for maintaining smooth operations.

Profitability Ratios

Profitability ratios measure a company's ability to generate earnings relative to its revenue, assets, or equity. These ratios help in understanding the firm's financial performance and operational efficiency. Common profitability ratios include the net profit margin, return on assets (ROA), and return on equity (ROE). By analyzing these ratios, investors can gauge how well a company is utilizing its resources to generate profit.

Solvency Ratios

Solvency ratios are used to evaluate a company's long-term financial stability and its ability to meet long-term obligations. These ratios provide insights into the firm's capital structure and financial leverage. Important solvency ratios include the debt-to-equity ratio and interest coverage ratio. A lower ratio generally indicates a more stable financial position, which is vital for long-term sustainability.

Understanding and analyzing these ratios can provide a comprehensive view of a company's financial health, helping stakeholders make informed decisions.

Cash Flow Evaluation Techniques

Evaluating cash flow is essential for understanding a company's liquidity, cash generation capabilities, and overall financial health. By focusing on cash flows, you can assess a company's ability to meet financial obligations, fund growth opportunities, and weather economic downturns.

Operating Cash Flow

Operating cash flow is a key indicator of a company's ability to generate cash from its core business operations. It provides insights into the efficiency of the company's operations and its ability to maintain and grow its business. Evaluating financial statements like the cash flow statement helps in understanding the true financial health of a business.

Free Cash Flow

Free cash flow represents the cash available after a company has met its capital expenditures. This metric is crucial for assessing a company's ability to generate additional value for shareholders. It also indicates the potential for reinvestment in the business or distribution to shareholders.

Cash Flow Forecasting

Cash flow forecasting involves predicting future cash inflows and outflows to ensure a company can maintain liquidity and plan for future financial needs. This technique helps in identifying potential cash shortages and surpluses, allowing for better financial planning and decision-making.

Cash flow evaluation is a critical component of accurate financial evaluation. While financial statements provide important information about a company's profitability and position, cash flow evaluation focuses on the actual cash inflows and outflows, providing a clearer picture of a company's liquidity and ability to meet financial obligations.

Comparing Different Valuation Methods

When it comes to valuing a business, there are several methods to consider, each with its own set of advantages and limitations. It's crucial to compare these methods to get a well-rounded view of a company's worth. Let's dive into the three primary valuation methods and see how they stack up against each other.

Market-Based Valuation

Market-based valuation methods operate by comparing the company in question to other similar companies. These methods involve calculating multiples and ratios, such as the price-to-earnings (P/E) ratio, to determine value. This approach is particularly useful when there is a lot of comparable market data available.

Income-Based Valuation

Income-based valuation focuses on the company's ability to generate future income. This method often involves discounted cash flow (DCF) analysis, where future cash flows are estimated and then discounted back to their present value. It's a powerful tool for understanding the long-term potential of a business.

Asset-Based Valuation

Asset-based valuation looks at the company's assets and liabilities to determine its net asset value. This method is straightforward and can be particularly useful for companies with significant tangible assets. However, it may not fully capture the value of intangible assets like brand reputation or intellectual property.

Each valuation method has its strengths and weaknesses and may be more appropriate depending on the specific circumstances. It is important to consider multiple valuation methods and compare the results to gain a comprehensive understanding of a company's worth.

Risk Assessment in Financial Valuation

Risk assessment is a continuous process that demands regular monitoring and updates. By identifying potential risks and opportunities, you can develop strategies to manage and mitigate risks while capitalizing on opportunities for growth and profitability.

Identifying Financial Risks

Identifying potential risks is a crucial part of accurate financial evaluation. It involves pinpointing uncertainties that may impact a company's financial performance, profitability, and stability. By assessing business operations, you can make informed decisions and mitigate potential negative impacts.

Mitigating Valuation Risks

Once risks are identified, the next step is to develop strategies to mitigate them. This can include diversifying investments, improving cybersecurity measures, and conducting thorough SWOT analysis. These steps help in reducing the risk of failure and ensuring a more stable financial outlook.

Opportunities in Risk Assessment

Risk assessment isn't just about identifying pitfalls; it's also about spotting opportunities for growth. By evaluating financial health and analyzing key performance indicators (KPIs), you can uncover areas for improvement and potential profitable opportunities. This proactive approach not only safeguards your investments but also paves the way for future success.

Regularly updating your risk assessment strategies ensures that you stay ahead of potential issues and capitalize on new opportunities.

Financial Modeling for Accurate Valuation

Financial modeling provides valuable insights into a company's potential future performance and helps in making informed decisions. By developing accurate and robust financial models, you can assess the impact of different scenarios, evaluate investment opportunities, and plan for the future.

Building Financial Models

Creating a financial model involves gathering historical data, making assumptions about future performance, and using these inputs to project future financial outcomes. A well-constructed model can help you understand the potential impact of different business decisions and external factors.

Scenario Analysis

Scenario analysis allows you to evaluate how different situations might affect your financial projections. By considering best-case, worst-case, and most likely scenarios, you can better prepare for uncertainties and make more informed decisions.

Sensitivity Analysis

Sensitivity analysis helps you understand how changes in key assumptions impact your financial model's outcomes. This technique is crucial for identifying which variables have the most significant effect on your projections and for testing the robustness of your model.

Financial modeling is not just about predicting numbers; it's about understanding the underlying drivers of financial performance and making strategic decisions based on that understanding.

Benchmarking for Better Valuation

Industry Standards

Understanding industry standards is crucial for accurate valuation. These standards provide a baseline that helps in comparing a company's performance against its peers. Adhering to industry standards ensures consistency and reliability in financial assessments.

Peer Comparisons

Peer comparisons involve evaluating a company's financial metrics against those of similar companies. This method helps in identifying strengths and weaknesses relative to competitors. It's a practical approach to gauge where a company stands in the market.

Performance Metrics

Performance metrics are essential for assessing a company's operational efficiency and profitability. Key metrics include return on equity (ROE), return on assets (ROA), and profit margins. These metrics offer insights into how well a company is utilizing its resources to generate profits.

Benchmarking is not just about comparison; it's about understanding where improvements can be made to achieve better financial health.

Leveraging Technology in Valuation

Valuation Software Tools

Valuation models have become increasingly complex over the last two decades. This complexity is driven by the advent of powerful computers and calculators, which have made previously time-consuming tasks achievable in minutes. Valuation software tools are now indispensable for financial analysts, providing robust platforms for detailed analysis and reporting. These tools help in assessing risks and challenges in business valuation: analyze industry-specific challenges, financial risks, and external factors to make informed decisions and explore growth opportunities effectively.

Automated Financial Analysis

Automation has revolutionized financial analysis, allowing for real-time data processing and reducing human error. Automated systems can quickly analyze vast amounts of data, providing insights that would be impossible to gather manually. This not only saves time but also enhances the accuracy of valuations. With automated financial analysis, businesses can stay ahead of market trends and make proactive decisions.

Data Analytics in Valuation

Data analytics plays a crucial role in modern valuation methods. By leveraging big data, analysts can uncover patterns and trends that inform more accurate valuations. Data analytics tools enable the processing of large datasets to identify key metrics and indicators. This approach ensures that valuations are based on comprehensive and up-to-date information, leading to more reliable financial assessments.

Embracing technology in valuation is not just about keeping up with the times; it's about gaining a competitive edge in the financial world.

Forecasting Techniques for Future Valuation

Forecasting financial performance is a complex yet essential task for accurate valuation. By leveraging various techniques, businesses can develop more precise and robust forecasts to support decision-making and strategic planning. Let's dive into some key methods.

Trend Analysis

Trend analysis involves examining historical data to identify consistent patterns or trends over time. This method helps in predicting future outcomes based on past performance. For instance, by analyzing historical sales data, you can identify seasonal patterns and forecast future sales more accurately.

Regression Analysis

Regression analysis is a statistical technique used to determine the relationship between variables. By understanding these relationships, businesses can make more informed predictions about future financial performance. This method is particularly useful for identifying factors that significantly impact financial outcomes.

Predictive Modeling

Predictive modeling uses statistical algorithms and machine learning techniques to forecast future events. This method can analyze large datasets to identify trends and patterns that might not be immediately obvious. Predictive modeling unlocks the power of smart investing by providing insights that help businesses make informed decisions.

By combining these forecasting techniques, businesses can transform their financial future with confidence and success.

Ensuring Continuous Improvement in Valuation Accuracy

Regular Review Processes

To maintain high standards in valuation accuracy, it's crucial to implement regular review processes. This involves periodically assessing and updating valuation models to reflect new information and market conditions. By doing so, you can ensure that your valuations remain relevant and precise.

Training and Development

Investing in training and development for your team is another key aspect. Continuous learning helps your team stay updated with the latest valuation techniques and tools. This not only enhances their skills but also boosts their confidence in making accurate financial assessments.

Adopting Best Practices

Finally, adopting industry best practices is essential for continuous improvement. This includes staying informed about the latest trends and methodologies in valuation. By integrating these practices into your processes, you can achieve more reliable and accurate valuations.

Continuous improvement is a journey, not a destination. By regularly reviewing processes, investing in training, and adopting best practices, you can ensure efficiency, continuously.

Conclusion

In the ever-evolving landscape of business, ensuring precise financial assessments is not just a necessity but a strategic advantage. By leveraging a variety of valuation methods and tools, businesses can gain a comprehensive understanding of their financial health and make informed decisions that drive growth and mitigate risks. Remember, while no single method is foolproof, combining multiple approaches can provide a more accurate and holistic view. So, whether you're an investor, business owner, or financial professional, embracing these techniques will undoubtedly pave the way for smarter financial strategies and a brighter future.

Frequently Asked Questions

What is valuation accuracy?

Valuation accuracy refers to the precision with which the value of an asset, liability, or equity balance is determined. It ensures that all figures presented in a financial statement are accurate and based on proper valuation methods.

Why is accurate financial evaluation important?

Accurate financial evaluation is crucial as it helps in making informed decisions, managing risks effectively, and identifying areas for improvement. Inaccurate evaluations can lead to costly mistakes, poor investment decisions, and missed opportunities.

What are common pitfalls in financial valuation?

Common pitfalls include over-reliance on a single valuation method, ignoring market conditions, and failing to account for all relevant financial data. These mistakes can lead to inaccurate valuations and poor decision-making.

How do financial statements contribute to valuation accuracy?

Financial statements provide essential data for valuation. The balance sheet, income statement, and cash flow statement offer insights into a company's financial health, performance, and cash flows, which are critical for accurate valuation.

What are the different methods of valuation?

The main valuation methods include market-based valuation, income-based valuation, and asset-based valuation. Each method has its strengths and is suitable for different scenarios.

How does ratio analysis aid in financial valuation?

Ratio analysis involves examining liquidity, profitability, and solvency ratios to assess a company's financial health. This analysis helps in understanding how well a company can meet its obligations, generate profit, and sustain operations.

What role does technology play in valuation?

Technology enhances valuation accuracy by providing advanced tools like valuation software, automated financial analysis, and data analytics. These tools streamline the valuation process and improve precision.

Why is continuous improvement important in valuation accuracy?

Continuous improvement ensures that valuation methods remain relevant and effective. Regular reviews, training, and adopting best practices help in maintaining high standards of accuracy and adapting to changing financial environments.